Scalping is a popular short-term trading strategy that involves making a large number of small profits from minor price changes in a stock or other asset. The goal of scalping is to exploit small price movements and achieve profits through quick, frequent trades. Here’s an overview of how scalping works:

1. Time Frame:

- Short Time Intervals: Scalpers typically use time frames of 1-5 minutes. They are looking to capitalize on tiny price changes over these brief periods.

- Fast Execution: To succeed in scalping, it’s crucial to execute trades quickly, often using a direct market access (DMA) broker or a fast trading platform.

2. Trade Frequency:

- Scalpers aim to make dozens or even hundreds of trades in a single day. Since the profits per trade are small, they rely on executing a large number of trades to build up their overall gains.

3. Tools and Indicators:

- Technical Indicators: Scalpers use technical indicators to identify entry and exit points. Some common tools include:

- Moving Averages (MA): Short-term moving averages like the 5-period or 10-period MA help identify trends.

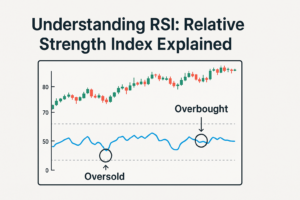

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions.

- Bollinger Bands: Used to measure volatility and potential breakouts.

- Volume: Helps identify strong market movements or potential price changes.

- Level II Quotes and Time & Sales: To gain an understanding of market depth, scalpers often monitor Level II quotes, which show real-time bid and ask prices.

4. Entry and Exit Points:

- Entry: A scalper enters the market when they see a small price movement or pattern that suggests a favorable opportunity. This could be a minor reversal or continuation in price.

- Exit: A scalper will exit as soon as the price moves a small amount in their favor. Scalpers may set tight stop-loss orders to protect themselves from large adverse movements.

5. Risk Management:

- Stop-Loss Orders: Since scalping involves quick trades with minimal price movement, it’s essential to use tight stop-loss orders to limit potential losses.

- Small Position Sizes: To minimize risk, scalpers often use small position sizes and avoid over-leveraging their trades.

- Trade During High Liquidity: Scalpers prefer trading when the market has high liquidity and low spreads to ensure that they can enter and exit trades quickly without significant price slippage.

6. Market Conditions:

- Scalping works best in volatile markets with high liquidity. During times of low volatility or in illiquid markets, it can be difficult to make small profits consistently.

7. Advantages of Scalping:

- Small Profit Per Trade: By targeting small price movements, scalpers can make profits on many trades, resulting in consistent returns over time.

- Reduced Exposure to Market Risk: Since scalpers hold positions for very short periods, they are less exposed to long-term market risks.

- High Activity and Engagement: Scalping can be exciting for traders who enjoy frequent decision-making and quick trades.

8. Disadvantages of Scalping:

- Requires Significant Time: Scalping involves a lot of trades, which can be time-consuming. It requires a high level of attention and focus.

- High Transaction Costs: Since scalpers make many trades, transaction fees (commissions, spreads, etc.) can eat into profits if not carefully managed.

- Stressful: The fast-paced nature of scalping can be mentally demanding and stressful for some traders.

Sure! Let’s dive deeper into some additional key aspects of the scalping strategy.

9. Types of Scalping Strategies:

Scalping isn’t just about entering and exiting the market quickly. There are a few different ways that traders might approach scalping:

a) Market Making:

- Market-making scalpers provide liquidity to the market by continuously placing limit orders on both the bid and ask sides. Their goal is to make a small profit from the difference between the bid and ask prices, known as the spread.

- This type of scalping is common in highly liquid markets, like forex or stocks with tight spreads.

b) Momentum Scalping:

- Momentum scalping involves taking advantage of short bursts of price movement in the direction of the prevailing trend.

- This method often combines technical indicators (e.g., RSI, moving averages) and volume spikes to determine when a quick price surge is likely.

c) Range Scalping:

- Range scalping focuses on trading between support and resistance levels.

- When a stock is moving within a range (not trending), scalpers buy at the support level and sell at the resistance level. These trades tend to be very short.

d) Breakout Scalping:

- This type of scalping involves entering the market when a stock breaks out of a well-established range. The idea is to capture the sharp movement when the price breaks above resistance or below support.

10. The Importance of Speed:

- Execution Speed: Since scalping relies on small price movements, you must execute trades quickly to avoid slippage (the difference between the expected price and the actual price you pay).

- Algorithmic Trading: Many professional scalpers use algorithmic trading systems or high-frequency trading (HFT) strategies to automate their trades and make split-second decisions faster than a human trader could.

11. Choosing the Right Market for Scalping:

- High Liquidity Markets: Scalping works best in markets where there is plenty of buying and selling activity. For example, the forex market is popular for scalping due to its high liquidity and low spreads.

- Stocks: Highly liquid stocks (e.g., large-cap stocks like Apple or Tesla) are often ideal for scalping because they have tight spreads and enough volume to allow for fast execution.

- ETFs: Exchange-traded funds can also be a good market for scalping, especially those that track major indices or sectors with high volume.

12. Tools of the Trade:

Scalpers use specific tools to ensure that they can enter and exit trades swiftly, such as:

a) Direct Market Access (DMA):

- This allows scalpers to place orders directly into the market without having to go through a broker. DMA reduces the time between deciding to make a trade and actually executing it.

b) Level II Quotes:

- These quotes show more detail about market depth, including the available bid and ask prices at various levels. They help scalpers see where there may be more support or resistance in the market.

c) Tick Charts:

- Tick charts display the price movement for each trade, rather than for each time period (e.g., 1-minute or 5-minute). Some scalpers use tick charts because they show a more granular, real-time picture of market action.

d) Scalping Software:

- Some brokers offer specialized software designed for scalping. This software often includes advanced order types, fast order execution, and customizable layouts to optimize trading.

13. Managing Slippage:

- Slippage occurs when the price of a trade changes between the moment the order is placed and the moment it’s executed.

- Since scalping depends on small price movements, even minor slippage can wipe out profits. To minimize slippage:

- Trade in highly liquid markets.

- Avoid news events that can cause unpredictable price spikes.

- Use limit orders to specify the price at which you want to enter or exit a trade.

14. Psychology of Scalping:

- Mental Agility: Scalping demands high mental focus, and you need to make decisions very quickly. This requires the ability to stay calm under pressure and avoid impulsive decisions.

- Emotional Control: Since the profits from each trade are small, there can be a temptation to over-trade or hold onto positions for too long. A disciplined approach is key, as overtrading can lead to excessive commissions and fees eating into your profits.

- Patience: While scalping is fast-paced, it also requires patience. Scalpers must wait for optimal entry and exit points and avoid chasing the market.

15. Risk of Overtrading:

- High Volume of Trades: Scalpers often make many trades in a single day. This can lead to overtrading, where the desire to keep making profits leads to taking unnecessary risks.

- Transaction Costs: With the high volume of trades, the associated costs (commissions, spreads, etc.) can accumulate quickly and eat into profits. It’s crucial to have a low-cost broker to avoid unnecessary fees.

16. Best Practices for Successful Scalping:

- Choose Liquid Markets: Focus on assets with high trading volumes and tight spreads. This helps minimize slippage and ensures you can enter and exit positions quickly.

- Use Tight Stop-Losses: Always use tight stop-losses to protect your capital in case the market moves against you. Scalping involves small moves, so even a few bad trades can quickly wipe out profits.

- Focus on One Asset: It’s often better to focus on one asset, like a stock or currency pair, and get familiar with its price movement patterns rather than trying to scalp across many markets.

- Backtest Your Strategy: Before live trading, use historical data to test and refine your strategy. This can help identify patterns and improve your chances of success.

17. Real-World Example:

Let’s say you’re scalping Stock A in the 1-minute chart. Stock A is in a tight range between $100.50 and $100.75. You decide to buy at $100.60 when the price touches the lower end of the range and then sell at $100.70 as it reaches the upper part of the range.

- Trade entry: Buy at $100.60.

- Trade exit: Sell at $100.70.

- Profit per trade: $0.10 per share.

If you make 100 such trades per day, you’d make $10 per day per 100 shares. This might seem small per trade, but with high-frequency trading, it adds up.

Certainly! Let’s dive even deeper into some more advanced aspects of scalping and practical tips to enhance your success with this strategy.

18. Advanced Scalping Strategies:

a) Order Flow Scalping:

- Order flow refers to the real-time buying and selling activity in the market. This strategy involves reading and interpreting order flow data to anticipate price movements.

- Footprint charts and order book analysis are essential tools for order flow scalping. By watching the large institutional orders and market participants’ behavior, scalpers can predict whether the price is likely to go up or down.

- This strategy relies on understanding where the large orders are placed, which can signal a potential breakout or reversal.

b) Scalping the News:

- While many scalpers avoid news events due to the volatility they create, some actively trade news. News-driven scalping involves taking advantage of small price movements that occur just before or after a major economic release (e.g., GDP numbers, non-farm payrolls, or earnings reports).

- This strategy requires a fast and efficient trading platform and the ability to quickly interpret the impact of news on a stock or currency.

c) Scalping Using Fibonacci Retracements:

- Fibonacci retracements are commonly used in scalping to find short-term support and resistance levels. For example, when an asset experiences a small pullback, scalpers may use Fibonacci retracement levels (38.2%, 50%, 61.8%) to identify potential reversal points and enter trades.

- This can be particularly useful in a choppy market where the price is moving in a range or retracing after a short burst of momentum.

19. Managing Market Conditions and Timing:

Scalping is highly sensitive to market conditions, and recognizing when conditions are favorable or unfavorable for scalping is crucial.

a) Best Time to Trade:

- High Volatility Hours: Scalping works best when the market is more volatile, as small price changes are more frequent. This usually occurs during:

- The first hour of the U.S. stock market opening (9:30 AM – 10:30 AM EST), as there is often a lot of volatility and price movement.

- Late European session (3:00 AM – 4:00 AM EST) if you’re trading forex, as this time sees both European and U.S. traders active.

- Avoid trading during low-volume periods or when the market is stagnant, like the middle of the trading day or on holidays.

b) Avoiding False Signals:

- Markets can give off false signals, especially during low volatility. A small price movement might seem like an opportunity but can quickly reverse, leading to losses. Understanding the market context is important for differentiating between a real trading opportunity and noise.

- To avoid false signals, many scalpers use multiple indicators to confirm their trades. For instance, a combination of moving averages, RSI, and volume analysis can help ensure you’re trading in the right direction.

20. Position Sizing and Leverage:

- Position Sizing: While scalping relies on small profit margins, the volume of trades can significantly add up. The size of each position should be adjusted to account for your risk tolerance, trade frequency, and the volatility of the asset.

- Leverage: Leverage can amplify profits in scalping, but it also amplifies losses. Many scalpers use high leverage to increase their position size without committing much capital. However, excessive leverage can lead to significant drawdowns. The key is to use leverage cautiously and not take on too much risk per trade. Example:

- If you’re scalping in a highly liquid forex market, you might use leverage of 10:1. With a $1,000 account, you could control $10,000 worth of the currency. The small profit from each trade will be amplified by leverage.

21. Risk Management in Scalping:

a) Risk-to-Reward Ratio:

- While scalping often involves taking small profits, maintaining a favorable risk-to-reward ratio is essential for long-term success. A typical scalper aims for a 1:1 or 2:1 risk-to-reward ratio, meaning they risk $0.10 to make $0.10 or $0.20 per trade.

- Many successful scalpers will place tight stop-loss orders (e.g., 5-10 pips) and only risk a small percentage of their capital per trade, ensuring that if they lose a trade, it won’t significantly affect their overall portfolio.

b) Fixed Stop-Loss and Take-Profit Levels:

- Establishing fixed stop-loss and take-profit levels before entering a trade helps limit emotional decision-making. For example, you may decide to exit a trade if the asset moves 0.05% against you or if it moves 0.1% in your favor.

- This method also allows you to plan each trade ahead of time, ensuring consistency and avoiding emotional reactions when a trade starts moving against you.

c) Risk Management with High-Frequency Trading (HFT):

- If you’re trading at a high frequency, position sizing and risk management become even more critical. By keeping each trade small and using automated strategies, scalpers can reduce the impact of market noise. However, you’ll still need to watch for periods of low liquidity or sudden volatility spikes, which can cause unexpected losses.

22. Avoiding Overtrading:

- Scalping involves making a lot of trades, but it’s important not to fall into the trap of overtrading. Overtrading happens when you enter trades without a clear signal or out of frustration after a losing streak.

- Discipline is key here. It’s best to define your trading hours, limits on the number of trades per day, and your daily loss limit. Once those limits are reached, you should stop trading for the day to avoid further emotional mistakes.

- Some scalpers also use a scalping journal to track all trades and outcomes. This allows them to analyze what worked and what didn’t, providing better decision-making in future trades.

23. Tools and Resources for Scalpers:

a) Advanced Charting Software:

- TradingView, MetaTrader 4/5, and NinjaTrader are some of the most popular platforms for scalpers. These platforms offer various technical analysis tools, such as moving averages, oscillators, and Bollinger Bands, that are essential for scalping.

- These platforms also offer customizable alerts that can notify you when your scalping strategy’s conditions are met.

b) Automated Trading Bots:

- Some advanced scalpers use trading bots to execute trades automatically based on predefined criteria. Bots can analyze data quickly and execute trades faster than humans, which is crucial in scalping.

- Tools like HaasOnline, 3Commas, or Cryptohopper (for cryptocurrency) can automate the entry and exit strategies based on your scalping parameters.

c) Backtesting:

- Backtesting is the process of testing your scalping strategy on historical data. It allows you to see how your strategy would have performed under various market conditions.

- Platforms like MetaTrader and TradingView offer backtesting features that let you refine your strategy before using it in live trading.

24. Psychological Aspects of Scalping:

a) Emotional Discipline:

- Because scalping involves making multiple trades in a short period, emotions like fear, greed, and frustration can quickly cloud judgment. Maintaining emotional discipline is vital.

- If you’re in a losing streak, it’s crucial to take a step back and reevaluate your approach. Avoid trying to chase losses by placing risky trades.

b) Avoiding FOMO (Fear of Missing Out):

- Since scalpers often operate in fast-paced environments, it’s easy to feel pressured to enter a trade when you see a quick price move. However, making decisions based on the fear of missing out rather than a strategic approach can lead to losses.

- Always stick to your plan and only trade when the market conditions match your criteria.

Let’s continue diving deeper into advanced aspects of scalping and address even more detailed strategies, techniques, and considerations that can help you refine your approach.

25. Advanced Scalping Techniques and Approaches:

a) Scalping Using Market Sentiment:

- Sentiment analysis involves evaluating the overall mood or attitude of the market, usually based on news, social media, or economic reports. Traders use this analysis to anticipate the next move in the market.

- Tools like the Fear & Greed Index or social media monitoring can be used to understand the general sentiment of traders. For example, when market sentiment is overly optimistic, it could indicate a potential reversal in price, making it a good entry point for scalpers.

- In addition, using economic calendars and understanding upcoming market-moving events (such as central bank meetings or earnings reports) can give scalpers an edge in predicting price movements.

b) Scalping with Candlestick Patterns:

- Candlestick patterns are essential for identifying short-term reversals and continuations in price movements. Some key candlestick patterns for scalping include:

- Engulfing Patterns: These are often used for predicting reversals at support or resistance levels.

- Doji Candles: A sign of indecision, indicating a possible price reversal or break.

- Hammer and Hanging Man: These patterns can signal a reversal when formed at the bottom or top of a trend.

- Combining candlestick analysis with other indicators like moving averages or RSI can improve your accuracy when scalping.

c) Scalping with Support and Resistance:

- Identifying key support and resistance levels is critical in scalping. Scalpers often look for bounces off these levels to enter trades, or they’ll trade the breakout if the price breaks through these levels.

- Price Action scalping involves using raw price movement without relying heavily on indicators. By watching how price reacts at these levels, scalpers can make quick, informed decisions.

- For example, if the price bounces off a strong support level, it might indicate a buying opportunity. Conversely, if the price breaks through a resistance level, it may suggest a continuation of the uptrend.

26. Scalping in Different Markets:

a) Scalping in the Forex Market:

- Liquidity: Forex markets are ideal for scalping because of their high liquidity, especially in major currency pairs like EUR/USD, GBP/USD, and USD/JPY. This allows scalpers to execute trades quickly without worrying about slippage.

- Volatility: Forex scalpers look for short-term price fluctuations in currency pairs. They may use short-term indicators (like 1-minute or 5-minute charts) to find quick, profitable trades.

- Market Hours: The best time to scalp forex markets is during overlapping trading hours (e.g., when both the London and New York sessions overlap, from 8:00 AM to 12:00 PM EST) when liquidity is high, and volatility spikes.

b) Scalping in Stock Markets:

- Tickers with Tight Spreads: Stocks with high liquidity and tight spreads, like large-cap companies (e.g., Apple, Tesla, or Amazon), are ideal for scalping.

- Pre-market and After-market Trading: Some scalpers take advantage of price movements in the pre-market or after-market hours when prices can experience substantial movement on light volume. However, liquidity can be a concern, so proper caution is needed.

- Earnings Reports: Scalping around earnings reports is a high-risk but potentially high-reward strategy. Price movements can be drastic, and scalpers need to be fast in entering and exiting trades based on earnings results.

c) Cryptocurrency Scalping:

- 24/7 Market: Unlike traditional markets, cryptocurrency markets operate 24/7, allowing for scalping opportunities around the clock.

- High Volatility: Cryptos are known for their extreme volatility, providing more opportunities for scalping. However, volatility also means risk, so strong risk management techniques are essential.

- Trading Pairs: Scalpers in the crypto market often trade pairs like BTC/USDT, ETH/USDT, or altcoin pairs with high liquidity and volatility.

- Slippage Concerns: Crypto markets, especially during high volatility periods, can experience significant slippage, so it’s important to trade on exchanges that offer deep liquidity.

27. High-Frequency Scalping and Algorithmic Trading:

- High-frequency trading (HFT) involves executing hundreds or thousands of trades per second. It relies on advanced algorithms and high-speed data feeds to identify and exploit inefficiencies in the market.

- While many retail traders don’t have the resources to compete with institutional HFT firms, understanding the concept and using algorithmic trading tools can enhance a scalper’s efficiency.

- Algorithmic trading bots can be programmed to scan the markets for specific patterns (e.g., price spikes, order book analysis, or technical setups) and automatically execute trades. This allows for ultra-fast decision-making that human traders cannot replicate. Example: A scalping bot might use technical indicators like the Exponential Moving Average (EMA) crossover system, automatically buying when the short-term EMA crosses above the long-term EMA and selling when the reverse occurs.

28. Scalping in a Low-Volatility Market:

- Low-Volatility Scalping: In a low-volatility market, price movements are smaller and more predictable. This type of scalping requires extreme precision and strict adherence to entry and exit rules.

- Tight Ranges: Scalpers focus on small price ranges, buying near the lower end of the range and selling at the upper end. Tight ranges often occur in sideways or consolidating markets.

- Avoiding False Breakouts: In low-volatility markets, scalpers must be cautious about false breakouts—small price movements that quickly reverse. Range-bound strategies can work well, but they require a keen understanding of market conditions.

29. Effective Scalping Platforms and Brokers:

Choosing the right platform and broker is critical for successful scalping. Here’s a breakdown of what to look for:

a) Fast Execution and Low Latency:

- Scalping requires fast execution and low latency (the delay between sending an order and its execution). If your broker’s platform is slow, you’ll miss trades or face slippage.

- Look for direct market access (DMA) brokers and ECN (Electronic Communication Network) brokers, which provide fast order execution and deep liquidity.

b) Low Spreads and Low Commission:

- Scalpers thrive on tight spreads, as even a small increase in spread can reduce profit margins.

- Some brokers offer commission-free trading with wider spreads, while others offer tighter spreads but charge a small commission per trade. The best choice depends on how often you trade.

- Always check the broker’s overnight fees if you’re holding positions overnight, as these can add up quickly and eat into your profits.

c) Scalping-Friendly Trading Platforms:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Both platforms are popular among scalpers for their low-latency execution, custom indicators, and algorithmic trading capabilities.

- NinjaTrader: This platform offers advanced charting and order execution tools, making it ideal for high-frequency traders.

- TradingView: Known for its user-friendly interface, charting tools, and custom alerts, TradingView is popular for scalping in both forex and stocks.

d) Zero Spread Brokers:

- Some brokers offer zero-spread accounts, ideal for scalpers who need very tight spreads. These brokers charge a fixed commission per trade but have no spread markup, which can be a great option for high-frequency trading.

30. Developing a Scalp Trading Plan:

Developing a solid trading plan is crucial for scalping success. Here’s what to include in your plan:

a) Set Clear Entry and Exit Rules:

- Define clear rules for entering and exiting trades. These can be based on:

- Technical indicators (e.g., RSI, MACD)

- Candlestick patterns (e.g., engulfing candles, Doji)

- Price action (e.g., bounce off support, breakout)

- Use limit orders for quick execution and to ensure you enter and exit at your desired price points.

b) Risk Management Guidelines:

- Set a daily loss limit: For example, if you lose 2% of your trading capital in one day, stop trading for the day.

- Decide on maximum risk per trade: Scalpers generally risk 0.5% to 1% of their capital on each trade.

- Always use stop-loss orders to protect your capital. Consider a tight stop-loss (e.g., 0.1% or 0.2% of the asset’s price) depending on your asset’s volatility.

c) Track Performance:

- Keep a detailed trading journal where you record each trade, including entry and exit points, profit/loss, strategy used, and any notes about market conditions. Analyzing past trades can help refine your strategy and improve your future performance.

Let’s continue with even more detailed and advanced techniques for scalping, focusing on deeper concepts and strategies that can further enhance your ability to successfully implement this style of trading.

31. Using Volume and Price Action Together in Scalping:

- Volume is one of the most important indicators for scalping, as it helps confirm the strength of a price movement. High volume typically indicates strong momentum, while low volume often signals weaker price moves.

a) Volume-Price Analysis:

- Volume spikes: When volume spikes alongside a price move, it indicates a strong price trend, making it a good entry point for scalpers. If the volume spikes and the price moves in the opposite direction, it could signal a false breakout or reversal.

- Volume divergence: If price moves in one direction (up or down), but the volume decreases, it could be a sign of weakening momentum. In this case, scalpers might decide to exit early to avoid a potential reversal.

- Combining price action (candlestick patterns, support/resistance, or breakouts) with volume analysis can improve your entry and exit timing.

b) Volume Weighted Average Price (VWAP):

- VWAP is a key technical indicator used by many scalpers. It is the average price of an asset, weighted by volume, over a specified period. When price is above the VWAP, it indicates an uptrend, while below VWAP signals a downtrend.

- Scalpers often use the VWAP to determine the overall trend and make trades that align with the direction of the market. For instance, in an uptrend (price above VWAP), a scalper may look to buy on pullbacks to the VWAP, whereas in a downtrend, they might look to sell on rallies to the VWAP.

32. Scalping Using Multiple Time Frame Analysis:

- Multiple Time Frame (MTF) analysis helps scalpers get a broader view of the market’s trend on various time frames (e.g., 1-minute, 5-minute, 15-minute, and 1-hour charts). The idea is to align trades on the lower time frames with the trend on the higher time frames.

a) Aligning Short-Term and Long-Term Trends:

- Example: A scalper might use the 1-minute chart for precise entry and exit points but also look at the 15-minute chart to confirm the overall trend.

- If the 1-minute chart shows a small pullback in a stock that is trending up on the 15-minute chart, the scalper may buy the pullback, expecting the trend to continue.

b) Using MTF for Trend Confirmation:

- On a 1-minute chart, if you spot a bullish flag pattern, you can confirm the bullish trend by checking the 5-minute or 15-minute chart. If the larger time frames are also showing bullish momentum, the scalper has additional confirmation for their trade.

- Similarly, if the short-term chart is showing a bullish setup, but higher time frames (like 1-hour or 4-hour) indicate a downtrend, the scalper might hesitate to enter the trade, waiting for more confirmation.

33. Scalping with Market Microstructure and Liquidity:

- Market microstructure refers to the way financial markets operate, including the rules and behaviors that impact pricing, liquidity, and order execution.

- Understanding how liquidity works in different markets can be crucial for successful scalping. Liquidity refers to how easily an asset can be bought or sold without affecting its price. More liquidity typically leads to tighter spreads and better fills, which is crucial for scalpers who rely on small price movements.

a) Order Flow and Market Depth:

- Market depth is a visual representation of the order book, showing how many buy and sell orders are at different price levels. Scalpers use this information to anticipate price moves and execute trades before others.

- By watching the order book for order imbalances (where more buy orders are stacked on one side than sell orders), scalpers can predict short-term price moves. For example, if there are many buy orders at a specific price, the price may rise once those buy orders are filled.

- Level 2 Data (market depth data) provides additional insight into which price levels are likely to hold or break. Scalpers can use this data to gauge the best entry and exit points.

b) Slippage and Impact of Liquidity:

- Slippage occurs when an order is executed at a different price than expected, usually due to low liquidity. Scalpers need to avoid trading during periods of low liquidity (e.g., outside major market hours or during economic reports) to minimize slippage.

- During periods of high volatility, prices can move rapidly, and slippage can erode profits. Understanding how liquidity impacts execution is crucial for smooth scalping.

34. Advanced Risk Management for Scalpers:

a) Using Trailing Stops for Scalping:

- Trailing stop-loss orders allow you to lock in profits as the market moves in your favor. When the price moves in your favor, the trailing stop automatically adjusts to maintain a fixed distance from the current price.

- This tool is beneficial for scalpers who want to secure profits while giving the trade room to breathe. For example, you might set a trailing stop to follow the price by 5 pips. If the price goes up by 10 pips, the stop loss moves up to lock in 5 pips of profit.

- Trailing stops help prevent a winning trade from turning into a loss by closing the position if the price reverses beyond a set point.

b) Position Sizing and Fractional Risk:

- Scalpers typically risk a small portion of their capital on each trade. For example, if you’re using a 1% risk per trade, you would risk 1% of your trading account value on each position.

- Fractional risk models allow for even more precision, where the risk per trade is scaled based on volatility, asset size, and trading strategy. For instance, risk per trade could vary from 0.5% to 1% depending on the asset’s volatility.

c) Scaling In and Out of Positions:

- Rather than placing a single large position, some scalpers scale in and out of trades, gradually increasing or decreasing their position size as the market moves in their favor.

- This approach helps reduce the risk associated with sudden market reversals and allows scalpers to take advantage of favorable price movements while managing exposure.

35. Psychology of Scalping: Overcoming Common Pitfalls:

a) Avoiding Emotional Trading:

- Scalping can be stressful, especially during losing streaks. Emotional decisions, like revenge trading, can lead to larger losses and erode profits.

- It’s crucial to stay calm and stick to your strategy. Implementing automated trading systems (e.g., trading bots) can help remove emotions from the equation, allowing you to follow your rules without second-guessing.

b) Managing Frustration and Burnout:

- Due to the intense nature of scalping, traders often experience burnout or fatigue. Taking regular breaks, adhering to a specific trading schedule, and maintaining a healthy work-life balance can help combat mental fatigue.

- If you find yourself feeling frustrated or emotional after a series of losses, it’s important to take a step back, review your trades objectively, and reevaluate your strategy.

c) Overcoming the Fear of Missing Out (FOMO):

- Scalpers often feel the urge to take every opportunity in the market, fearing they might miss a profitable move. However, this FOMO mentality leads to overtrading and poor decision-making.

- It’s essential to stick to your trading plan, only executing trades when your entry criteria are met. Having a well-defined trade checklist can prevent you from chasing every small price move.

36. Scalping Software and Tools:

a) Customizable Alerts:

- Many scalpers use price alerts or indicator-based alerts to notify them when a setup occurs. Platforms like TradingView, MetaTrader, and NinjaTrader allow you to set up alerts based on various conditions (price crossing a certain level, indicator crossover, etc.), helping you stay ahead of potential trades without needing to constantly monitor the market.

b) Scalping Software and Tools:

- Order Flow Tools: Tools like Bookmap and Depth of Market (DOM) are advanced platforms that display order flow and market depth in real-time. These are especially useful for order flow scalping, as they allow you to see large buy or sell orders and anticipate market movements based on the volume.

- Trading Bots: For those interested in automation, trading bots such as 3Commas, HaasOnline, or MetaTrader Expert Advisors (EAs) can automatically execute scalping strategies, handling entry and exit points based on predefined conditions.

37. Scalping in Different Asset Classes:

a) Scalping in Commodities:

- Commodities like gold, oil, and agricultural products can also be scalped, but they are typically more volatile than stocks or forex. Scalpers often look for short-term trends, breakouts, or news-related events that move commodity prices.

- Be mindful of macro events, such as geopolitical tensions or natural disasters, which can cause sudden price spikes in commodities.

b) Scalping in Futures Markets:

- Futures markets are a great fit for scalping because of their liquidity and tight spreads, especially in E-mini contracts (such as E-mini S&P 500 or E-mini NASDAQ).

- Futures scalpers focus on very short-term movements, typically using tick charts or short-term price action setups to enter and exit trades.

Let’s continue with even more in-depth strategies and advanced techniques for scalping, expanding on specific aspects that can further enhance your scalping game.

38. Using Algorithmic Scalping (Algo-Trading):

- Algorithmic trading involves using computer programs to execute trades based on predefined rules. It’s especially useful for scalping, where speed and precision are crucial. Algorithms can scan for specific patterns, conditions, and price movements faster than a human could ever react.

a) Scalping Bots:

- A scalping bot executes trades automatically based on certain criteria, such as price action, moving averages, RSI, or other technical indicators. Bots are especially useful for high-frequency trading (HFT), where numerous small trades are made in a very short period.

- Common bots used in scalping include 3Commas, HaasOnline, Cryptohopper (for crypto), and MetaTrader Expert Advisors (EAs) for forex and stocks.

b) Backtesting Algorithms:

- Backtesting is an essential step in algo-trading. It involves running the trading algorithm on historical data to see how it would have performed in the past.

- Use platforms like QuantConnect, MetaTrader 5, or TradingView to backtest your scalping strategies before deploying them in a live market environment.

- You can fine-tune the bot’s behavior by optimizing parameters such as stop-loss size, take-profit targets, or the indicators it uses, ensuring it operates with your desired risk-reward profile.

39. Scalping with Advanced Indicators:

a) Bollinger Bands:

- Bollinger Bands can be an effective tool for identifying periods of low volatility (squeeze) that might precede significant price movements.

- Scalping Strategy:

- When the price moves near the lower Bollinger Band, it could indicate an oversold condition and potential reversal or bounce.

- When the price approaches the upper Bollinger Band, it might indicate an overbought condition, presenting a potential short trade.

- A Bollinger Band squeeze occurs when the bands tighten, signaling low volatility. Scalpers often use this as a prelude to enter trades as the price breaks out from this tight range.

b) Stochastic Oscillator:

- The Stochastic Oscillator is a momentum indicator that compares the closing price of an asset to its price range over a specified period.

- Scalpers use this indicator to spot overbought and oversold conditions. Typically, readings above 80 signal overbought conditions (potential sell), and below 20 signal oversold conditions (potential buy).

- A Stochastic crossover (when the %K line crosses above the %D line) is a strong signal for scalpers to take action in line with the trend.

c) Ichimoku Cloud:

- The Ichimoku Cloud is an advanced indicator that provides insights into support and resistance, trend direction, and momentum. It’s a more comprehensive indicator than traditional moving averages.

- Scalpers use the Cloud (Kumo) to spot trend reversals and find areas of support or resistance. When price is above the cloud, it’s typically a bullish trend, and when below, it’s a bearish trend.

- The Tenkan-Sen (conversion line) and Kijun-Sen (base line) crossovers can signal entry points for scalpers.

40. Scalping Using News and Events:

a) Scalping During Economic Announcements:

- News-driven scalping can be highly profitable, as economic reports often cause rapid and significant price movements. Key reports include:

- Non-Farm Payroll (NFP) (for forex)

- Interest Rate Decisions (for central banks like the Fed, ECB)

- Earnings Reports (for stocks)

- GDP Growth Reports (for various markets)

- The key is to act fast. Scalpers focus on economic surprise (where the actual result differs from expectations) to capture short-term market movements.

b) Event-Driven Scalping:

- News events such as geopolitical developments, natural disasters, or corporate mergers/acquisitions can trigger sharp, unpredictable price movements. Scalpers who stay ahead of breaking news can capitalize on these moves.

- Tools like economic calendars and news feeds from platforms like Reuters or Bloomberg can help you stay updated on potential market-moving events.

- Scalpers often use algorithms or bots to trade around major events, executing buy/sell orders automatically once certain thresholds or news triggers are met.

41. Advanced Trade Management Techniques:

a) Scaling In and Out of Positions:

- Scaling in refers to increasing your position size as the trade moves in your favor, while scaling out refers to reducing position size incrementally as the price moves in the desired direction.

- This approach is particularly useful in trending markets where you anticipate continued movement in the same direction. Scalpers might start with a small position and add more once the trend is confirmed.

- Conversely, scaling out helps protect profits. Instead of closing your entire position at once, you gradually exit the trade at different price levels.

b) Partial Take-Profit and Stop-Loss:

- Partial exits are an effective technique for protecting profits while still leaving some exposure to further price movements.

- For example, you might take 50% of your position off the table at your first profit target and move the stop-loss to break-even for the remaining position. This way, you lock in profits while still leaving some of your position open to capture additional gains.

c) Trailing Stop for Locking In Profits:

- Trailing stops can be used to automatically lock in profits as the price moves in your favor. The trailing stop moves up (or down) with the market and ensures that if the market reverses, your position is closed with a profit rather than a loss.

- Example: You enter a trade at $100, set a trailing stop at $99. If the price moves up to $105, the trailing stop automatically moves to $104. If the price then falls to $104, your position is closed with a $4 profit.

42. Scalping in Low-Volume and High-Impact Markets:

a) Scalping in Low-Volume Periods:

- Some scalpers choose to trade during low-volume periods (e.g., during the Asian session in forex or early hours in the U.S. stock market). While there is less price movement, there is also less market noise, which can provide clearer entry signals.

- Range-bound strategies work well during low-volume periods. Scalpers can trade the price bouncing between key support and resistance levels.

b) Scalping During High-Impact Events:

- High-impact events, such as geopolitical tensions, major economic announcements, or central bank interventions, can cause sharp price moves within a very short time frame. These market conditions are ideal for scalping, as the price volatility provides ample opportunities for quick trades.

- For example, during a central bank announcement or earnings report, price can spike dramatically within seconds, offering quick profits for scalpers who can capitalize on these moves immediately.

43. Scalping in Different Market Conditions:

a) Scalping in Trending Markets:

- In trending markets, scalpers look for pullbacks or retracements within the main trend to enter trades. For example, in a strong uptrend, scalpers look to enter during minor pullbacks, buying the dip.

- Momentum indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help identify strong trends and entry points.

b) Scalping in Sideways or Consolidating Markets:

- Scalping in sideways markets can be more challenging as price does not move strongly in one direction, but it also offers opportunities.

- Range trading strategies can be effective here. Scalpers buy near support and sell near resistance. However, it requires precise entry and exit points, as false breakouts are common.

- Using indicators like Bollinger Bands or RSI can help identify when the price is overbought or oversold in a range-bound market.

44. Scalping with Market Timing:

a) Scalping During Market Open or Close:

- Scalpers often prefer to trade during the market open or market close, as these times tend to exhibit the highest volatility and liquidity.

- Opening range breakouts can provide significant movement within the first 15-30 minutes of the market opening. This volatility can be captured for quick profits.

- Similarly, the market close often experiences a surge in volatility as traders adjust their positions for the next trading day.

b) Trading During High-Liquidity Periods:

- Scalpers benefit from high liquidity because it reduces the spread and minimizes slippage. The London-New York overlap (8 AM to 12 PM EST for forex) or the opening hours of the U.S. stock market (9:30 AM EST) are typically ideal for scalping, as they have the highest trading volume and the tightest spreads.

Certainly! Here are even more advanced techniques and insights for refining your scalping strategy and achieving success in this fast-paced trading style.

45. Scalping in Different Asset Classes (Continued):

a) Scalping in Cryptocurrencies:

- The cryptocurrency market has unique characteristics that make it ideal for scalping, such as high volatility, 24/7 trading, and the potential for rapid price swings.

- Key aspects of crypto scalping:

- Volatility: Cryptocurrencies are known for their price fluctuations, and scalpers can capitalize on these swings. However, this volatility also increases risk, so risk management (e.g., stop-losses) is crucial.

- Low Liquidity Coins: While high liquidity coins like Bitcoin and Ethereum are great for scalping, low-cap altcoins can offer huge potential for quick profits. However, these assets can also be manipulated more easily, so caution is needed.

- Indicators for Crypto Scalping: For cryptos, scalpers often use moving averages, RSI, and Bollinger Bands to identify overbought and oversold conditions. The MACD (Moving Average Convergence Divergence) is also popular for spotting changes in momentum.

b) Scalping in Options:

- Scalping options involves exploiting small price movements in the underlying asset over short periods.

- Options for Scalpers:

- Short-Term Expiration: Scalpers prefer options with very short expiration times (e.g., weekly options or day trading options). These options offer more frequent price fluctuations.

- Implied Volatility: Scalpers in options must consider implied volatility because options prices can change rapidly when volatility spikes. A sharp rise or fall in implied volatility can significantly impact option premiums.

- Delta and Gamma: Scalpers should understand Delta (how much the option’s price moves relative to the asset) and Gamma (how fast Delta changes) to make informed scalping decisions.

46. Utilizing Advanced Technical Patterns for Scalping:

a) Advanced Candlestick Patterns:

- Candlestick patterns are vital in scalping because they provide visual clues about market sentiment and price direction in very short time frames.

- Advanced Candlestick Patterns:

- Engulfing Patterns: These are powerful reversal patterns that occur when a small candle is followed by a larger candle that “engulfs” the first one. A bullish engulfing pattern suggests that buyers have overtaken the sellers, signaling a potential uptrend. A bearish engulfing pattern indicates the opposite.

- Doji: The Doji candlestick pattern signals indecision in the market, meaning buyers and sellers are in equilibrium. It can serve as a potential reversal signal when found at key support or resistance levels.

- Hammer and Hanging Man: These candlesticks often signal reversals. A hammer at the bottom of a downtrend signals a potential bullish reversal, while a hanging man at the top of an uptrend signals a potential bearish reversal.

b) Chart Patterns:

- Flag and Pennant Patterns: Both are continuation patterns that indicate short-term consolidation before the market continues in the direction of the prevailing trend. These patterns are particularly useful for scalpers, as they allow you to enter trades when a breakout occurs.

- Double Top and Double Bottom: These reversal patterns signal that the price has reached an extreme level, either at the top or bottom. A double top indicates a potential market reversal to the downside, while a double bottom signals a potential bullish reversal.

47. Advanced Risk Management Strategies:

a) Kelly Criterion for Position Sizing:

- The Kelly Criterion is a formula used to determine the optimal size of a series of bets, and it can be applied to position sizing in scalping. It helps you balance risk and reward by calculating the percentage of your account to risk on each trade based on your edge (win rate and average profit/loss).

- Formula: ( f^* = \frac{p}{l} – \frac{1-p}{w} ) Where:

- ( f^* ) = optimal fraction of your account to risk

- ( p ) = probability of winning

- ( w ) = win size (average profit)

- ( l ) = loss size (average loss)

- This method helps scalpers avoid risking too much capital on any one trade, preserving their account balance while maximizing long-term growth.

b) Risk-to-Reward Ratios:

- Although scalping typically involves small profit targets, maintaining an appropriate risk-to-reward ratio is crucial to ensure profitability over the long term.

- Common Ratios for Scalpers:

- 1:1 Risk-to-Reward: This is a common approach where you risk 1 pip or tick to gain 1 pip or tick. Scalpers can often use this ratio because of the tight price movements in fast markets.

- 1:2 or 1:3: A more conservative approach. For every 1 pip of risk, you aim to capture 2 or 3 pips in profit. This strategy ensures that even if you lose half of your trades, you can still be profitable overall.

c) Trade Scaling with Dynamic Position Sizing:

- Dynamic position sizing allows you to adjust the size of your positions based on the volatility or risk of the trade. For instance, if the market is more volatile, you may choose to trade smaller position sizes to mitigate risk.

- Volatility-Based Position Sizing: Use indicators like Average True Range (ATR) to gauge market volatility. Higher volatility means higher position sizing, while lower volatility means smaller position sizes.

48. Scalping with Artificial Intelligence (AI) and Machine Learning:

a) AI-Driven Scalping Systems:

- AI and machine learning are being used more frequently in scalping strategies. These systems use vast amounts of historical data to identify patterns and trends that are not immediately obvious to human traders.

- How AI helps in Scalping:

- Pattern Recognition: AI systems can analyze charts and detect complex patterns that may be difficult for a human trader to spot. The AI can then execute trades based on these patterns with incredible speed.

- Predictive Modeling: Machine learning models can predict future price movements based on historical data and market sentiment. These predictions can give scalpers an edge by forecasting the most likely price action.

- Automated Scalping Bots: AI-driven bots can execute trades automatically based on predefined algorithms. These bots can optimize your trading strategy in real-time, adjusting for changes in market conditions, volatility, and liquidity.

b) Backtesting AI Models:

- One of the significant advantages of AI in trading is the ability to backtest strategies against historical data at a speed and scale that human traders cannot match. By testing various strategies over long periods and across different market conditions, AI can find the best parameters for scalping.

49. Understanding the Role of Market Makers and Liquidity Providers:

a) Market Makers:

- Market makers provide liquidity to the market by continuously quoting buy and sell prices for assets. They profit from the spread between these prices.

- Scalpers can benefit by understanding the behavior of market makers. For instance, market makers may push prices in certain directions to fill large orders, creating opportunities for scalpers to enter at optimal points.

b) Liquidity Providers:

- Liquidity providers (LPs) facilitate large transactions in low-liquidity markets. Scalpers need to be aware of high liquidity levels because when liquidity is thin, spreads widen, and slippage becomes more common.

- By trading when liquidity is abundant (e.g., during market openings or the London-New York overlap), scalpers can reduce the risks associated with slippage.

50. Scalping with Behavioral Finance and Sentiment Analysis:

a) Behavioral Finance for Scalpers:

- Behavioral finance studies how psychological factors influence market behavior. Understanding common market biases can give scalpers an edge by predicting when the market is likely to overreact or underreact.

- Herd behavior: When traders follow the crowd, pushing prices too far in one direction.

- Loss aversion: Traders often avoid realizing losses, which can cause price movements to linger longer than expected.

- By recognizing these biases, scalpers can identify situations where prices are likely to reverse or consolidate, creating opportunities for profit.

b) Sentiment Analysis:

- Sentiment analysis involves analyzing the tone of news, social media, and market reports to gauge overall market sentiment (bullish or bearish). Scalpers can use sentiment indicators to predict short-term price movements based on shifts in market mood.

- For example, Twitter sentiment analysis tools can track whether the market is feeling positive or negative about an asset based on social media posts. A sudden shift in sentiment can lead to quick price changes that scalpers can take advantage of.

51. Scalping Strategies for High-Impact Markets:

a) Scalping during Volatile Markets:

- Volatile markets present both challenges and opportunities for scalpers. While the volatility allows for large price moves, it also increases the risk of slippage and false breakouts.

- Scalpers need to use tight stop-losses and scalping strategies like breakout trading and mean reversion to manage volatility effectively.

- Avoiding Overtrading: In volatile markets, it’s easy to get caught up in the action and overtrade. Scalpers should have a clear entry and exit plan, taking only the best trades and avoiding chasing the market.